Operational risk is a part of every business that is often overlooked until things go wrong. This risk can be costly, stemming from process breakdowns, system failures, or external events. Just software operational failures can cost up to $2.41 trillion globally. Whether it’s a cyberattack leading to data loss or supply chain issues causing delivery delays, operational risks can significantly impact business performance and reputation.

As businesses expand and adopt new technologies, these risks become more complex and potentially harmful. A Deloitte survey found that most executives now see operational risk as a significant concern because of how easily it can interrupt essential functions and damage customer trust. Identifying and managing these risks is vital to smooth operations and sustainable growth.

What is Operational Risk Management?

Operational risk management identifies, assesses, and mitigates risks arising from an organization’s day-to-day operations. These risks can come from various sources, such as human errors, system failures, fraud, legal compliance issues, or external events like natural disasters.

Operational risks can seriously impact productivity, customer trust, and financial stability. For instance, a simple data entry mistake could lead to erroneous financial reporting, while a system outage could halt production, resulting in lost revenue.

Types of Operational Risk

Operational risks can take multiple forms within an organization, each impacting operations differently. Here are some primary types of operational risks:

|

Type of Operational Risk |

Description |

|

Internal Fraud |

Dishonest activities conducted by employees, such as theft or falsifying records. |

|

External Fraud |

Deceptive actions by outside individuals, including cyberattacks and identity theft. |

|

Process Risk |

Inefficiencies or errors in internal workflows that disrupt operations, such as miscommunication or outdated processes. |

|

Technology Risk |

Failures related to systems and technology, including system breakdowns or inadequate cybersecurity measures. |

|

Legal and Compliance Risk |

Potential violations of laws and regulations lead to legal penalties and reputational damage. |

Importance of Operational Risk Management

Managing operational risk is crucial for organizations of all sizes. It helps ensure the smooth functioning of daily operations, protects against financial losses, and safeguards a company’s reputation. Here are some important reasons why enterprise operational risk management is essential:

- Financial Protection: Effective operational risk management can prevent significant financial losses. Organizations that proactively manage their operational risks are less likely to experience costly disruptions. By identifying and mitigating potential risks, businesses can protect their bottom line.

- Regulatory Compliance: Many industries are subject to stringent regulations. Non-compliance can lead to hefty fines and legal repercussions. Companies with robust operational risk management frameworks are better positioned to meet regulatory requirements, reducing the likelihood of penalties and legal challenges.

- Enhancing Operational Efficiency: Identifying inefficiencies within processes can improve workflows and productivity. Organizations focusing on operational risk management often discover hidden inefficiencies, enabling them to streamline processes and enhance overall performance.

- Reputation Management: Operational failures, such as data breaches or service disruptions, can damage a company’s reputation. Adequate operational risk controls protect customer trust and maintain a strong reputation. Companies with operational solid risk and business continuity management are viewed more favorably, leading to increased customer loyalty.

- Business Continuity: Effective operational risk management ensures a business can continue during disruptions. This is particularly important in today’s fast-paced and unpredictable market environment. Organizations with comprehensive operational risk solutions are better prepared to handle crises and minimize their impact.

Operational risks can arise across various business functions, often stemming from the need to prioritize resources, manage personnel, and maintain systems. Here are some examples:

1. System Maintenance Decisions

Example: When a company faces multiple maintenance needs but can only afford to address one, deciding which system to repair first can have a significant impact. If one system is neglected, it may fail, leading to direct operational disruptions and potential financial loss.

2. Personnel Management

- Sales Performance: While retaining an underperforming sales team as a cost-saving measure may reduce immediate expenses, it can negatively impact overall performance, particularly in sales-driven organizations.

- Manufacturing Efficiency: Relying on external contractors instead of hiring a qualified in-house mechanic introduces operational risks. Due to limited on-site expertise, this choice can lead to inefficiencies and production delays.

3. Employee Behavior and Fraud Risks

Fraudulent activities by employees pose a serious operational risk, with the potential for substantial business repercussions. Such risks highlight how operational efficiency is closely linked to employee behavior and the integrity of organizational decision-making.

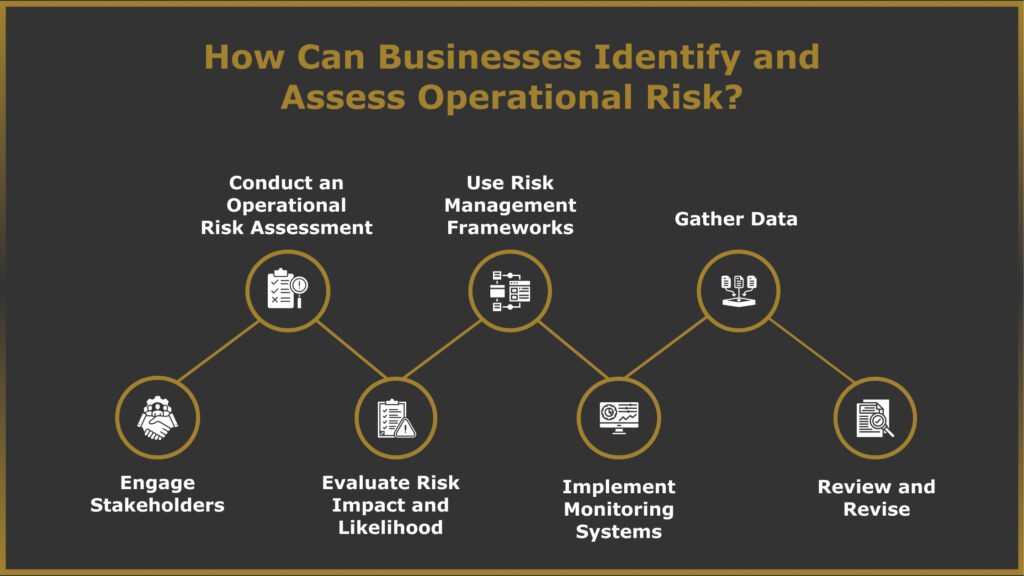

How Can Businesses Identify and Assess Operational Risk?

Identifying and assessing operational risk is critical for businesses aiming to enhance their resilience and efficiency. Here are some critical steps involved in the operational risk management process:

1. Conduct an Operational Risk Assessment

Begin with a comprehensive operational risk analysis to identify potential operational risks. This involves reviewing all business processes and activities to pinpoint areas that may expose the organization to risks, such as equipment failures, inadequate staffing, or compliance issues. Engaging teams from various departments can provide a well-rounded view of the risks present across the organization.

2. Use Risk Management Frameworks

Adopting established risk management frameworks, like the COSO (Committee of Sponsoring Organizations of the Treadway Commission) framework or ISO 31000, can help structure the identification and assessment process. These frameworks provide guidelines and best practices for managing risks and ensuring that all potential threats are considered.

3. Gather Data

Collect quantitative and qualitative data related to operational activities. This includes performance metrics, historical incident reports, and employee feedback. Analyzing this data can reveal patterns and areas where risks are most likely to occur, aiding in a more accurate assessment.

4. Engage Stakeholders

Involve stakeholders in risk identification, including employees, management, and external experts. Their insights and experiences can uncover risks that may not be immediately apparent. This collaborative approach can also enhance buy-in for risk management initiatives.

5. Evaluate Risk Impact and Likelihood

Assess the potential impact and likelihood of identified risks. This can be done using qualitative assessments (such as expert opinions) or quantitative methods (like statistical models). Categorizing risks based on severity can help prioritize which ones require immediate attention.

6. Implement Monitoring Systems

Establish systems to monitor identified risks continuously. This includes regular reviews of processes and controls to ensure they remain effective. Automated tools can assist in tracking risk indicators and provide alerts when thresholds are breached.

7. Review and Revise

Operational risks can evolve as business processes and environments change. Therefore, it is crucial to regularly revisit the risk assessment to identify new risks and adjust strategies accordingly.

Strategies to Manage and Mitigate Operational Risk

Mitigating operational risk is essential for ensuring the smooth functioning of a business. Here are several effective strategies that organizations can adopt:

- Appoint a Skilled Chief Operating Officer (COO): A competent COO plays a vital role in managing operational risk. The certified operational risk professional understands the intricacies of operational processes and can implement effective strategies to enhance efficiency. A skilled COO ensures alignment between operational goals and overall business objectives for better growth.

- Improve Internal Control: Establishing strong internal controls helps reduce the risk of errors and fraud. This involves developing clear procedures for transactions and compliance and conducting regular audits to ensure adherence.

- Invest in Training and Development: Continuous training equips employees with essential skills and promotes an understanding of company policies. Training should also include risk awareness and prepare employees to effectively recognize and manage potential risks.

- Implement Technology Solutions: Utilizing technology can streamline operations and minimize human error. Automated systems and data analytics provide real-time insights, enabling quicker responses to emerging risks.

- Conduct Regular Risk Assessments: Regularly evaluating operational risks helps organizations identify new threats and adjust strategies accordingly. A structured approach to risk assessment ensures comprehensive coverage of potential issues.

- Develop a Business Continuity Plan: A solid business continuity plan prepares an organization for unexpected disruptions. This includes identifying critical processes and recovery strategies and ensuring staff are familiar with emergency procedures.

- Promote a Culture of Transparency: Encouraging open communication creates a workplace culture where employees feel comfortable reporting risks. Anonymity in reporting can enhance this transparency, allowing staff to express concerns freely.

- Establish Vendor Management Practices: Assessing third-party vendor risk management practices is essential when working with them. Strong vendor management policies help mitigate risks associated with outsourcing and ensure compliance with agreements.

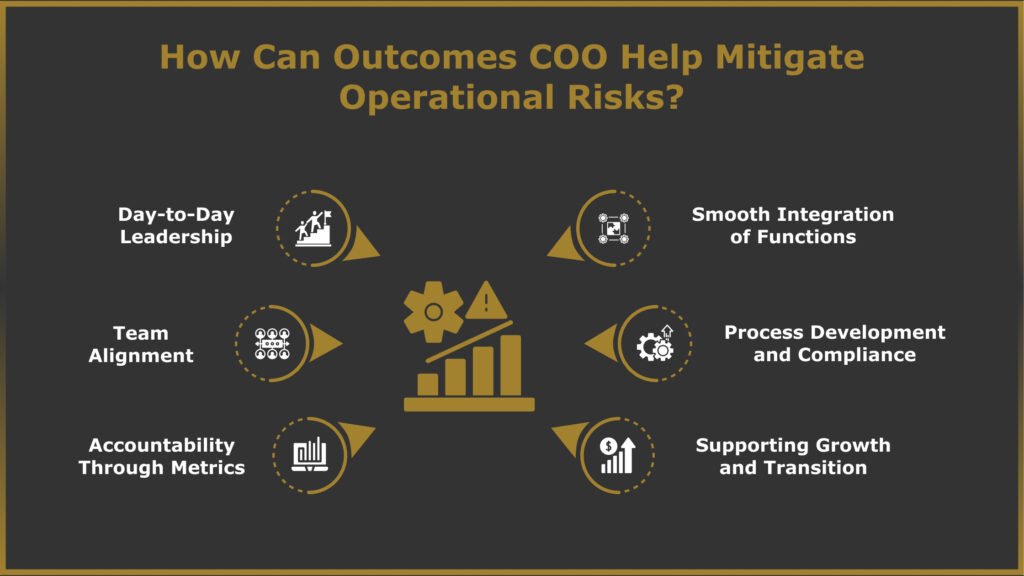

How Can Outcomes COO Help Mitigate Operational Risks?

Outcomes COO provides expert Fractional COO services tailored for businesses generating between $4 million and $40 million in revenue. This arrangement is ideal for companies that do not require a full-time COO but still seek operational expertise to navigate complexities and drive efficiency. Here’s how Outcomes COO can assist organizations in managing operational risks and enhancing performance:

1. Day-to-Day Leadership

A Fractional COO can oversee daily operations, allowing business leaders to focus on their core strategic initiatives. By managing the routine aspects of the business, the COO helps reduce chaos and create a more structured environment, ultimately lowering operational risk.

2. Team Alignment

Ensuring that the right talent is positioned in the right roles is essential for operational success. Outcomes COO emphasizes aligning team members with the organization’s objectives, fostering a culture where everyone works collaboratively towards shared goals, thereby minimizing the risk of misalignment.

3. Accountability Through Metrics

Outcomes COO enhances organizational visibility by implementing departmental scorecards and key performance indicators (KPIs). This system ensures teams align with business objectives and enables swift corrective actions for any arising issues.

4. Smooth Integration of Functions

Fractional COOs facilitate the integration of various departments within a company, enhancing communication and collaboration. Such a strategy allows the organization to respond more efficiently to operational challenges.

5. Process Development and Compliance

Outcomes COO assists organizations in developing standard operating procedures, ensuring that these practices are consistently followed to enhance reliability and efficiency.

6. Supporting Growth and Transition

A Fractional COO can provide valuable insights and strategies for businesses aiming to scale or prepare for an exit. This support is crucial for managing the operational complexities associated with growth or transitions, helping organizations maintain stability and resilience.

Partnering with a Fractional COO from Outcomes COO provides businesses with the necessary expertise to manage operational risks while effectively pursuing their strategic goals. Outcomes COO helps organizations simplify operations and achieve sustainable growth by focusing on leadership, accountability, and process optimization.

Manage and Mitigate Operational Risks with Outcomes COO!

Is your business facing operational challenges that hinder growth? With Outcomes COO, you can access tailored Fractional COO services to optimize efficiency and reduce risks. Our experienced team works closely with you to align your operations with your strategic goals, ensuring that the right people are in the right roles and everyone is working toward a common vision.

Don’t let operational inefficiencies hold your business back. Reach out to Outcomes COO today and discover how our expertise can streamline your operations and drive sustainable growth.